As tax season is coming to a close, a lot of taxpayers are getting notices from the Internal Revenue Service that they need to verify their identity after they submit their tax documents. DO NOT IGNORE THIS NOTICE. If the IRS is asking you to complete an online verification form that they sent to you via letter in the mail, it is vitally important that you follow the steps below. The reason the IRS has sent this letter to you is because the IRS believes that someone has filed a tax return in your name to get a fraudulent return, essentially meaning your tax return has been stolen. See the steps below on how to protect yourself from this tax-related identity theft.

A suspect will file a fraudulent return under your social security number to get a refund. Once this is on file, the IRS may suspect, but not know whether you are a victim of identity theft. It is important to identify whether you are a victim of tax-related identity theft.

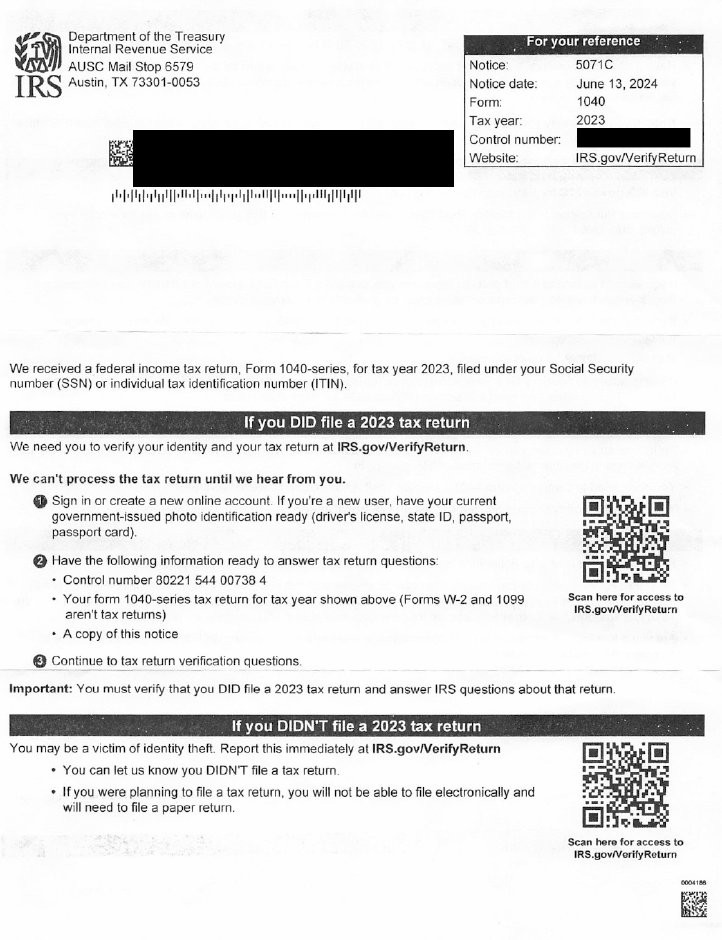

Step 1 – Internal Revenue Service’s Request

When filing your tax return with the IRS, the IRS may say that a tax return has already been filed in your name. This will be the first indicator that you might be a victim of tax-related identity theft. Another identity theft indicator will be a letter that you may receive from the IRS requesting you to verify your tax return. Below is an example.

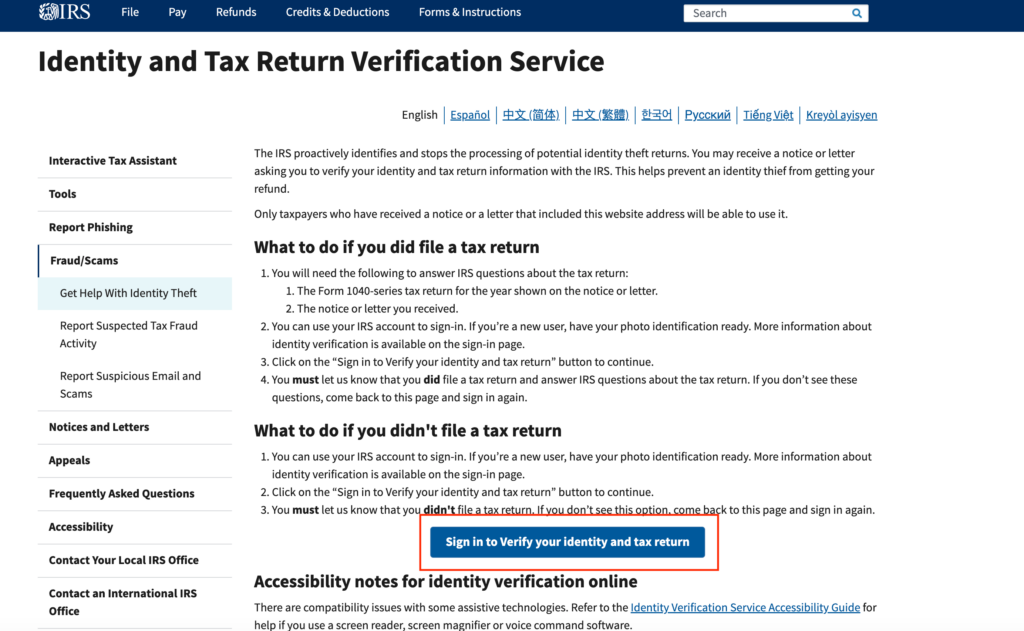

Step 2 – Online Verification

Next, you will need to visit the website provided in the letter IRS.gov/verifyreturn. Once there, you will need to click the blue button that says, “Sign in to Verify your identity and tax return.” Once you click this, you will be rerouted to either sign in or create an ID.Me account.

Step 3 – Tax Return Filed?

Once signed in, you will need to answer questions about whether you filed a tax return. The IRS will also ask you whether or not you owed money or were supposed to get a return. If your answers do not match the tax return claiming the opposite, then the IRS will note you as an identity theft case. If someone else electronically filed your tax return, then you will need victim assistance.

Step 4 – Refile Tax Return

If taxpayers are confirmed victims of tax-related identity theft, then they will need to file a paper return. Similarly, they will need to get an identity protection pin. An IP PIN is a PIN that is a form of identification for future filings to prevent another fraudulent refund scenario. It is important that you save this IP PIN as you will need it for all future tax filings.

Step 5 – Protecting Your Credit

Since it appears that you are a victim of a stolen social security number, it is important to stop this fraud from becoming widespread identity theft. Here are several tips to check how far the identity theft has gone and how to stop its spreading.

- Check your credit report to see if a fraudulent account has been created in your name. Tips on pulling and reviewing your credit report are here.

- Put a freeze on your credit report so no one can open an account in your name. See how to freeze your credit here.

If you have further questions, your tax return has been stolen, or you are a victim of identity theft and require a skilled attorney in your corner, simply contact Barthel Legal today.